Bitcoin Market Overview

In the following widget, there is a live Bitcoin price with other useful market data, including Bitcoin’s market cap, trading volume, daily, weekly and monthly changes, total supply, highest prices and more. bass, etc. By default, the price of Bitcoin is indicated in Euros, but you can easily change the base currency to USD, British Pounds, Japanese Yen, Korean Won and Russian Rubles.

Bitcoin value

Find out the value of Bitcoin from the major cryptocurrency exchanges: Binance, Bitfinex, Bitstamp, Coinbase, HitBTC, Kraken, Okex. Select the check box to compare prices between the exchanges in the charts. Various views are available: Candlestick, OHLC, Line Chart. Use the buttons to switch between the Bitcoin charts.

By default, the information is provided for the last week, but users can choose a day / week / month / year, three months of data, or a custom period.

Read more: Bitcoin Baccarat

There is a built-in print and download feature for Bitcoin price charts. There is the possibility of downloading data in .xls / .csv format.

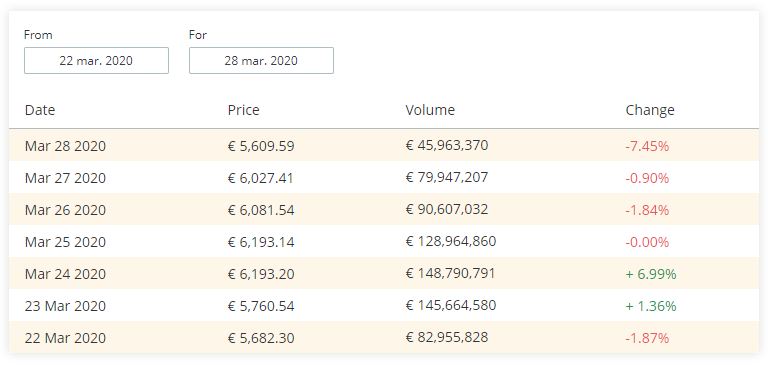

Bitcoin historical price

This section contains the history of the Bitcoin (BTC) price. Feel free to customize the time period to view the price history for the required time. In the columns there are date, price, volume and change. The date describes the day of the registered price, the price shows the value of Bitcoin as of that date, the volume column shows the volume of operations of the currency for the current day and the change indicates the percentage change in the price of the currency.

Bitcoin information

Bitcoin (BTC) is a decentralized consensus network, designed to enable a global value transfer and payment system, since it has its own native currency. The system is completely digital and allows interaction between network users without a central authority that determines them.

On October 31, 2008, an individual or group of people, using the pseudonym Satoshi Nakamoto , published the Bitcoin White Paper on the mailing list of a group of privacy activists known as cypherpunks. The system proposed “an exclusively peer-to-peer version of electronic money, which allows online payments to be sent directly from one party to another without going through a financial institution,” as the document reads.

Bitcoin has a total supply of 21 million coins and, except for a radical change in the protocol, agreed between the members of its network, there can be no more. The rules of its protocol limit the amount of emission and reduce it every certain period of time (approximately every 4 years through a process known as halving), making it more complex to acquire each unit in cash. As a consequence, circulating bitcoins become scarcer and revalue over time.

A bit of history about the price of Bitcoin: evolution of the price of Bitcoin

The bitcoin price has been evolving over the years and has had some milestones that are worth considering:

- On May 22, 2010, the first transaction was made with bitcoin. A Florida programmer named Laszlo Hanyecz paid 10,000 bitcoins for two Papa John’s pizzas. We hope they were tasty since at today’s price those pizzas would be worth millions.

- In February 2011, the price of BTC exceeded the price of 1 euro for the first time, reaching a price of almost 30 euros in the middle of the year.

- However, a report on the unrestricted exchange market, Silk Road, left the cryptocurrency very bad, which closed 2011 at 2 euros. Bitcoin grew significantly again and 2013 was a particularly important year in this regard. At the beginning of that year, each BTC was priced at 25 euros and by the end each bitcoin was priced at 1,000. The fact that bank withdrawals were banned in Cyprus has been considered a possible cause for this huge growth. However, this growth was not sustained, especially due to a catastrophic event in the ecosystem: MtGox, which at that time was the largest exchange office, was hacked. The event meant the theft of 850,000 bitcoins and the price of each bitcoin plummeted. Bitcoin went from more than 800 euros to less than 500.

- In 2017, the CME incorporates a Bitcoin product for the first time in a regulated exchange in the United States.

- In 2017 bitcoin reached its historical maximum price, reaching almost 20,000 euros.

- 2018 was a year of correction, and each bitcoin came to be priced at just over 3,100 euros.

- During 2019 there was an interesting bullish rally. Bitcoin once again surpassed the barrier of 10,000 euros, and even its price came to be above 13,000 euros in the middle of the year.

How much is a Bitcoin worth?

As we said, the value of bitcoin is very volatile. The answer to the question “how much is a bitcoin worth” is never going to be the same. You should also take into account the pair with which you are rating bitcoin. The most common pairs are bitcoin dollar and bitcoin euro (BTC / USD and BTC / EUR). But as you can see in the graph above, we show you the price of bitcoin according to the main currencies. In addition to the bitcoin dollar and bitcoin euro pair, you can see how much a bitcoin is worth against the pound sterling (BTC / GBP), the Japanese yen (BTC / JPY), and the Russian ruble (BTC / RUR). As bitcoin adoption spreads, volatility levels are expected to drop to provide much more stable prices than today.

How is the bitcoin price formed?

Markets determine trends through supply and demand, that is, through the interest of buying or selling an object. If the market is very interested in acquiring a certain object and said object is limited, the price of said object will increase. It is what we call a demand higher than the existing offer in the market. On the other hand, if the supply of a certain product increases above the real demand for said product within the market, its price will tend to decrease. Supply can increase for many reasons: excess production, impossibility of limiting the population’s access to the product, etc. In the case of bitcoin, your offer is already determined from the beginning. 21 million Bitcoins is the maximum production cap that will be seen within the Blockchain networkof this cryptocurrency. With a limited offer, what will interest us to set the price will be your demand within the markets.

And what kind of markets are those that mark the prices of Bitcoin? The Exchanges or Exchange Houses that serve as a platform to exchange FIAT currency for Bitcoin. In these spaces, people place their offers both to buy or to sell, they can do it freely without any kind of limitation.

It may interest you: Bitcoin Baccarat

Analysis of price variations

There are basically two ways to analyze Bitcoin price variations and behavior: technical analysis and fundamental analysis. Fundamental analysis: (H3) The analysis is one that attempts to establish a theoretical price through the study of various variables that affect its value. Rather than finding a prediction about price rises or falls, it considers approximations in time, affected by issues such as the general economic situation, financial statements, economic environment, etc.

It could be said that there are two perspectives to take into account the variables that affect the value of the price: one of the microeconomic type and the other of the macroeconomic type.

Technical analysis:

The technical analysis is one that studies the movements of the quotations through charts and indicators based on the prices of the assets, taking into account the behavior of buyers and sellers.

The price of Bitcoin moves in different directions, and its behavior can be analyzed in a similar way to that of, for example, stocks on the stock exchange. Thus we can see that sometimes it rises, other times it falls and other times it remains static, it does not move. Then, the technical analysis takes into account these movements (rise, fall or the so-called lateral movement), with the aim of predicting a possible future movement. A large number of mathematical tools are used for this.

What is the volume of Bitcoin?

Bitcoin volume is the monetary value at which an asset has been traded for a specified period of time. Volume is a key indicator of market activity and liquidity, implying that at higher volumes there is greater trading interest between buyers and sellers for that asset. Bitcoin volume represents the trading value (buy and sell) of BTC generally in the last 24 hours.